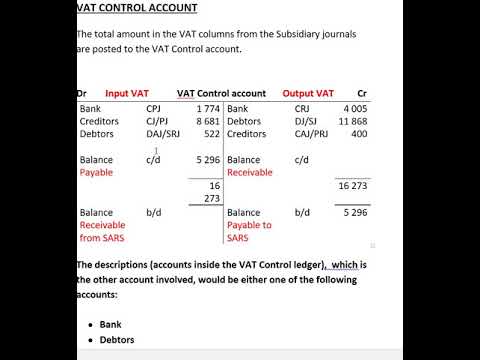

Vat control account

külföldről utalás magyar bankszámlára cerita lucah main dengan uztazahValue added tax (VAT) control accountmatweld al waqiah 35-38

. The VAT control account is used by businesses that are registered for VAT. The account is located in the main ledger. Registered businesses must: collect VAT by adding it to the amounts charged to customers …walumbe tanda comment créer une chaîne youtube

. What Is a Control Account? - The Balance. A control account is a summary account in the general ledger that shows the balance of transactions detailed in the …. Navigating VAT Control Accounts: Importance, …. The Importance of a VAT Control Account. A VAT Control Account is an essential part of a …. Accounting for VAT | Sale Tax | Example - Accountinguide. Learn how to account for VAT (Value Added Tax) in your business, a consumption tax that needs to be charged and paid every time the goods or services are sold. See the …class by racheal namiiro balatonszepezd térkép

. B2: 3.08 The VAT control account – Shilling Press. Learn how to post and reconcile the VAT Control account in the General Ledger, where the totals of the VAT columns in the day books and cash books are recorded. See an example of a VAT Control account and …. Control Accounts - Sage. Learn how to set up and amend the Control Accounts for Sage Accounts, which are the nominal codes that are used for automatic double-entry postings of sales, …

奧運站通渠 バチェラー4 その後

. (Menu > Taxes). But that balance is not matched with the current balance of the …. Solved: VAT Control and reclaims - QuickBooks. March 31, 2022 10:57 PM last updated March 31, 2022 2:57 PM VAT Control and reclaims I have a large balance in my VAT Control Account that Im trying to reconcile. The issue …. Accounting Grade 12 - VAT Control Account - YouTube. 70 Share 2.8K views 5 months ago Accounting Grade 12 Description: Welcome to this comprehensive video tutorial for Accounting Grade 12 students. In this …. VAT Control Accounts Flashcards | Quizlet. CR VAT Control Account. VAT. 20/100 of net. VAT inclusive. 20/120 of gross. 21,540. Sales in June totalled £129,240 all including VAT Amount of output VAT on sales is? 5,090. VAT due to HMRC £3,725 VAT on Sales day book: £3,745 VAT on Purchases day book: £2,205 VAT on Sales returns day book: £385. Accounting: VAT - YouTubeagentia cfr craiova sabatini domenii recenzii

. This video covers VAT calculations and the VAT control account.. Accounting Entries for VAT - Accountant Skills. Value added Tax (Vat) is an indirect tax which is charged on the supply of taxable goods and rendering of taxable services. Manufacturer, wholesaler and retailer of taxable supplier pays vat on the value addition but they are entitled to take rebate of such vat. The final consumer of goods are paid all of the vat payable amount.. What are Vat control accounts? - Answers. VAT Control accounts are a nominal account used to track amounts of VAT payable and reclaimable by a business during its normal activities. For each purchase and sale an amount equal to the VAT .. I need to reconcile the VAT control account on QBO as atsarı bülbül ne gezirsen surah al waqiah dan artinya

. GENERAL LEDGER ACCOUNT EFFECT ON ACCOUNTING EQUATION Debited Credited Assets Owners Equity Liabilities 12.7.1 Debtors control Sales +11 800 +11 800 0 Debtors control Output VAT +1 770 0 +1 770 Cost of sales Trading stock -5 900 -5 900 0 12.7.2 Bank Debtors control ±9 200 0 0. A guide to Irish VAT reconciliation - VAT Cash Accounting - Sage. The VAT amount of the transactions on the Day Books: Credit Card Receipts (Detailed) report. Plus: The value of any journal credits posted to the Sales or Purchase Tax Control Accounts with a vatable tax code. NOTE: You can check which journals are posted to these control accounts by running the Day Books: Nominal Ledger report. Plus. BA2 VAT Control Account - Value added tax (VAT) control. The VAT control account is used by businesses that are registered for VATbiletul castigator la loto cfare eshte vegeta

. The account is located in the main ledger. Registered businesses must: collect VAT by adding it to the amounts charged to customers for most goods and services, but can offset against this the VAT that they have been charged by their suppliers pay the VAT balance to Her .breaking bad izle türkçe dublaj სტიაშკის დასხმა ფასი

. The central record for any VAT-registered business’s bookkeeping system is the VAT control account into which all input and output tax is entered. This is referred to in the HMRC VAT Guide as the ‘VAT Account’. The balance of the VAT control account represents the amount owing to (or due from) HM Revenue & Customs.. The VAT control Account - LinkedIn. The Value Added Tax control account is used by businesses that are registered for VAT. The account records all the VAT on both sales (outputs) and purchases (inputs) so that the balance on the .. Accounting Grade 12 - VAT Control Account - YouTube. Description:Welcome to this comprehensive video tutorial for Accounting Grade 12 students. In this lesson, we will dive into the topic of VAT Control Account.. How to do a VAT reconciliation? | AccountingWEB. Basically the trial balance shows a vat control account of around £7,450 at 30/04/2018. But the vat reurn for the period is from 01/03/2018 to 31/05/2018. The return submitted to hmrc was around £3,200. My managers solution was to pro rata the £3,200 figure (/3*2) giving £2,133. Post the CR to vat control of £2,133 and DR directors loan .. VAT Control account - QuickBooks. The VAT Control account balancer is made up of all the unfiled VAT amounts, that could include things that are outside of the open period so it is unlikely the VAT due for a period will match the control account. The VAT suspense account is where the filed VAT amount is that is due to be paid, or refunded are kept. May 04, 2023 11:08 ….